News & Views: Market Predictions During Economic Uncertainty

Watch the companion News & Views online discussion forum here.

Predicting the Impact of Current Events

Scholarly publishers are wondering how the COVID-19 pandemic and the unfolding economic downturn will impact the scholarly journals market. Of course, this is an impossible question to answer definitively, but are there events in the past that we can use for guidance?

This month we look at the impact of the 2007-2008 financial crisis, bringing some longstanding historical analysis linking GDP and publishing revenues up to date. Our aim is to see what factors may act as a barometer of the economic impacts we might expect during this challenging time.

Historical View

The STM Association industry reports have done a great job of assembling figures, albeit from different sources which use different methodologies. The reports only go back to the mid-2000’s. Together, they suggest that:

- The broader STM market managed to sustain growth rates of 4%-5% from 2007-2012, dropping steadily to around 3.5% going into 2021.

- The Journals market averaged growth of 5%-6% from 2008-2011, dropping to 2.5% from 2013 onwards, and further to around 2.1% going into 2021.

- Even the same sources may restate numbers as different analysts form different views, or as definitions change. There have been cases of higher growth figures mentioned but attributed to currency effects.

Despite the variability of historic data, we think it is fair to say that the Journals market has shown low to mid-single-digit growth, regardless of the economic cycle. In particular, the market weathered the 2007-2008 downturn well.

Historically, the volume of output has been driven by the continued real-terms growth in research and development expenditure and the rising number of researchers:

- The numbers of articles (published annually) and journals have a long-term annual growth of 3.5% and 3% respectively.

- Growth in output has accelerated to 4% per year for articles and over 5% for journals in recent years.

- Some studies have placed article growth even higher – at around 6%.

Updating the historical baseline

The industry reports demonstrate a close relationship between numbers of journals, articles, and numbers of researchers. This seems intuitive. It is based on work dating from 20031 and includes data from 1990 to 1995.

To determine a baseline for comparison, we updated the 2003 view to see if the same factors held now, and if we could form a view that spanned the 2007-2008 downturn. We looked at data for:

- Volume of article output – overall and in major indexes.

- Gross domestic expenditure on research and development (GERD) and its relationship to GDP.

- Population, numbers of researchers, and numbers of all workers in R&D.

- Journal market growth (as stated in various industry reports).

We examined various combinations between the variables above to identify the strongest relationships. Subscribers to our Data and Analytics Tool can review the detailed data; below we present the headlines.

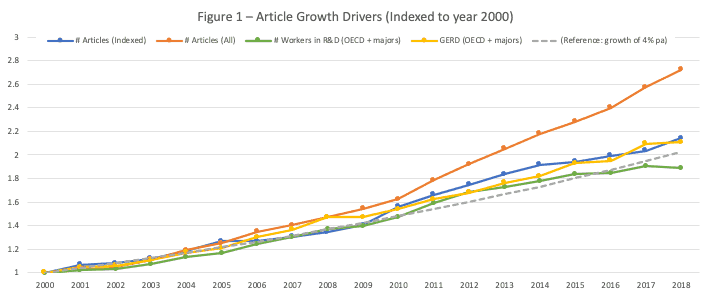

In the following results, all data are indexed relative to the year 2000, and CAGR spans 2000-2017. All sources have lead times, with some more recent data falling off-trend as a result.

Factors Related to Growth in Volume of Articles

Sources: SCImago (Scopus), Dimensions, OECD, World Bank, Delta Think analysis. See footnotes for full citations.

© 2020, Delta Think Inc. All rights reserved.

The figure above examines the factors influencing growth in volume of articles.

- Articles in indexed journals2 have a CAGR of 4.3% (the blue line).

- Articles in the broader literature3 have a CAGR of 5.7% (the orange line).

- This difference in numbers hints at a growing “long tail” of literature which lies outside the mainstream indexes. (Although not shown above, we see a similar pattern in numbers of journals.)

- GERD4 (the yellow line) – particularly of the world’s largest economies, as tracked by the OECD5 – shows the strongest relationship with growth in numbers of articles. (99% correlation.)

- The total number of workers in R&D in OECD countries (the green line) also shows a very strong relationship with growth in article output (and with growth in journal numbers – not shown, but notable). Note, this is all workers – not just researchers.

- The number of researchers in R&D globally shows the strongest relationship with inflation-adjusted journal market value, followed by GERD and then average GDP per capita. (Around 80%-90% correlation.)

Projecting results to the future

Activity remained pretty consistent across the 2007-2008 downturn, with downturns in GDP having little (if any) short-term effect on article volume. The 2003 analysis looking at researcher numbers largely holds true, albeit with the nuance of looking at all workers in R&D in countries with the largest economies.

Subscription revenues have historically weathered downturns well, as mild falls in activity do not lead to a collapse in subscriptions and subscription price is not directly tied to article volume. Price pressures are not new in the subscription market but may increase if institutional budgets are impacted by a weakening economy.

While the majority of scholarly publishing revenue is still derived from subscription models, Article Processing Charge-based (APC) Open Access now has roughly five times the market share it had in 2007-2008. Fully OA journals employing APC-based business models rely on article throughput. Their revenue could be more quickly impacted by article volume changes, putting some proportion of the 6.75% of total journal revenue that is associated with APCs at risk.

Additionally, with COVID-19 threatening to have a profound effect on the global workforce for an unknown period of time, the effective numbers of R&D workers across disciplines may fall at some point in the future. Currently, our anecdotal evidence points to an initial increase in submissions for many journals. We suspect this might be the result of researchers focusing on writing up results from completed research when they are unable to get into their labs.

However, this boost in activity may be short-lived. If significant numbers of researchers cannot continue their work, and we see a reduction in the number of personnel overall, then the data suggest we could see a reduction in article volume and in journal market value.

Conclusion

When we started this analysis, our working hypothesis was that the scholarly journals market could pull off its old trick of weathering choppy waters well.

However, the data suggest that this time things may be different. The key factors related to journal market value look set to fall significantly, and the balance of business models across the marketplace has changed. It seems likely that a fall in the numbers of researchers and global economic activity will lead to a decline in the overall market size for journals publishing.

As is always the case, averages are not distributed equally throughout the market. Fully APC-based Open Access publishers are more at risk, because of their dependency on article volume and the close connection of their cash-flow to throughput. This reality may drive a shift towards non-APC based OA, such as subscription and membership models applied to OA.

Publishers with significant subscription-based income – especially the large ones – are (arguably) in the better position. However, they may see increased pricing pressure from a library market responding to deeper cuts in funding than we saw in 2007-2008. And, of course, any publishers relying on events will have seen these and similar in-person revenues disappear abruptly.

In fact, some mixed-model publishers may look to increased OA activities to help make up lost ground elsewhere. The same headwinds that challenge OA also make it more responsive.

We wish all our readers and their extended families, friends, and colleagues well through these challenging times.

Notes

Please note: since this piece was published, some minor edits were made to remove reference to GDP, and clarify the wording about journal market value.

- Mabe, M., 2003. The growth and number of journals. Serials, 16(2), pp.191–197. DOI:http://doi.org/10.1629/16191

- We use SCImago (based on Scopus) for the index. Web of Science will yield similar results.

- Dimensions.ai, filtered for Publication Type: Article.

- GERD: Gross domestic expenditure on research and development, shown as PPP at constant currencies. The World Bank normalizes to 2011 USD, the OECD to 2015 USD. Both sources experience lead times, and work on 2-year cycles for many countries (sometimes longer), so more recent data is likely to understate numbers. Methodologies have varied over time.

- OECD data covers OECD countries and prospective members: Australia, Austria, Belgium, Canada, Czech Republic, Denmark, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Japan, Korea, Luxembourg, Mexico, Netherlands, New Zealand, Norway, Poland, Portugal, Slovak Republic, Spain, Sweden, Switzerland, Turkey, United Kingdom, United States, Argentina, Chile, China, Chinese Taipei, Estonia, Israel, Latvia, Lithuania, Romania, Russia, Singapore, Slovenia, South Africa.

Sources

- Delta Think, Open Access Data and Analytics Tool

- SCImago. (2007). SJR — SCImago Journal & Country Rank. Retrieved July 5, 2019, from http://www.scimagojr.com

- Ulrich’s Periodicals Directory, Ulrichsweb.com

- The OECD (2020), Research and Development Statistics, retrieved March 2020.

- World Bank, World Development Indicators (2020)

- Digital Science, Dimensions (2020)