News & Views: Market Sizing Update 2025 – Has OA recovered its mojo?

Overview

After a rocky couple of years, the open access (OA) market may be finding its footing again. Each year, Delta Think's Market Sizing analyzes the value of the OA scholarly journals market—that is, the revenue generated by providers or the costs incurred by buyers of content.

Our analysis estimates that the OA segment expanded to just under $2.4bn in 2024. Although growth has improved compared with last year’s deceleration, it continues to lag behind the broader historical trend for OA.

The proportion of articles published as OA has declined slightly, likely driven by continued reduction in the output from the large OA publishers. This trend has benefited established publishers, who saw growth in OA activity and revenue as they continued to consolidate their positions.

Looking ahead, OA could soon begin outpacing the broader journals market once again—but likely through different growth drivers than in the past.

Read on to see what those shifts might look like.

Headline findings

Our models suggest the following headlines for the 2024 open access market:

- Market size: We estimate that the OA market grew to just under $2.4bn in 2024, an increase of 6.8% over the previous year. Although an improvement on the low growth the year before, this is still only one quarter of its historic growth rates.

- Overall journals market: We estimate the total scholarly journals market to have increased by 2.3% in 2024, compared with its long-term low single-digit growth around 5%.

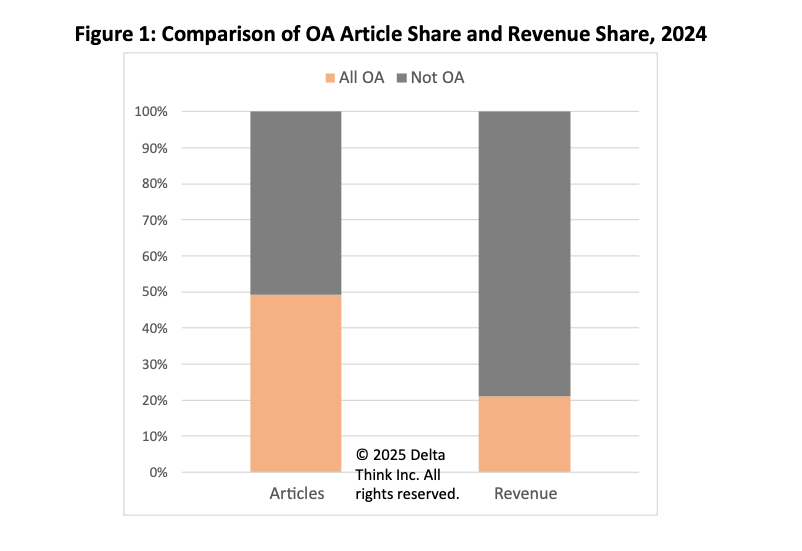

- OA share of output and value: Just under 50% of all scholarly articles were published as paid-for open access, accounting for slightly over 20% of corresponding market value.

- Fully OA publishers: Large, fully open access publishers saw a significant drop in their article output in 2024. The share of fully OA articles shrank slightly, but fully OA share of revenue ticked up. We anticipate both volume and value may begin to recover next year.

- Hybrid OA: Hybrid continues to make up for some of the shrinkage in fully OA output with both hybrid article and revenue growth remaining strong. Slightly higher-priced fully OA options have also likely contributed to fully OA’s increasing revenue.

- Currency effects: Without currency effects, OA market value would have grown by nearly 11%, and the overall journals market by 7.3%. This suggests that underlying growth in the OA market value has recovered since last year, and the overall market grew above long-term trends.

- Future outlook: OA publishing has once again outpaced the broader journals market. From 2024 to 2027, we anticipate a CAGR (average growth each year) of 7.7% in OA output and 12% in OA market value-- roughly double last year’s projections, though still just below long-term averages.

A note about our method

As ever, we are very grateful to the organizations that participate in our annual survey, which we anonymize and aggregate to inform our estimates. We will soon send our usual detailed market update and analysis to participants, which breaks out fully OA and hybrid details.

Our market estimates focus on research publications for which money is likely to be paid, either to read or to publish. Our definition of open access excludes “bronze” (public access) and “green” (repository-only) articles.

Rather than simply looking at annual figures, we extract underlying trends and leverage historical data to identify trends and inform strategic decision-making. Each year our underlying data may change as data sources improve and evolve their methods. We continue to refine our view on resulting trends as more information becomes available. Therefore, each year we restate historic figures as needed to keep them up to date.

Trends

OA’s share of output has leveled off – and may stay that way for the next year or two. However, even with that flat output, OA’s share of revenues continues to rise. Authors appear to be choosing slightly higher-priced OA options compared with a few years ago. Hybrid OA is capturing more of the OA mix, yet long-term growth still depends on trends in fully OA output.

Delisting fallout stabilizes

The delisting of journals from Web of Science in 2023 had a knock-on effect across OA-only publishers’ portfolios. Quality concerns centered on special issues, which had been a major driver of OA growth. It seemed unlikely that (many of) these articles would find other outlets. Last year, we noted that this disruption stalled fully OA growth. This year’s data suggest that the bleeding has largely stopped, with fully OA articles output down only slightly in 2024.

OA output has plateaued

OA’s total share of output has hovered around 50% (± one percentage point) since 2022. Last year we asked whether OA had peaked. The evidence points to a plateau, at least for now. While a major driver of (fully) OA growth has been removed – or at least reduced – publishers are adapting and beginning to recover. We anticipate that fully OA output will begin growing again next year, outpacing the broader market, though not returning to its “glory days” of a few years ago.

Revenue growth continues—slower but steadier

After a pause in progress last year, OA continues to take share of total publishing revenue, albeit at a slower pace. Authors have shifted towards established publishers, who saw strong increases in both OA volume and revenue, even as the overall OA market has softened.

Authors appear to be paying slightly higher publication fees, likely for two reasons:

- Fully OA APCs charged by the big corporates are often (though not always) higher than those from OA-only publishers.

- Hybrid OA APCs are higher still – and hybrid’s share is growing.

Subscription output still matters

Subscription (non-OA) publishing output and revenue continue to grow, even though its market share is slowly shrinking.

The value gap narrows

Since 2022, around 50% of published output has been OA, accounting for about 20% of total market value. By 2027, we anticipate OA’s value share could reach 25%, even if output remains stable. OA articles still generate less revenue per paper than subscription articles, but that gap is likely to keep narrowing as publication fees increase—a trend we project will continue.

Mixed-model deals remain a wildcard

The impact of transformative and mixed-model deals on pricing dynamics is not yet clear. Consolidation enables large publishers to grow OA revenues, but if read-and-publish deals have price caps, some OA output moving from smaller OA publishers to larger ones might not translate into higher OA revenue overall.

Policy and funding shifts may reshape the field

It is too soon to tell how recent changes in US policy and funding may influence market valuations, but these shifts could alter both pricing and output patterns in coming years.

Early indications from Delta Think’s Researcher Survey suggest that a significant portion of researchers expect to publish fewer articles, including some who specify fewer OA articles. A follow up survey underway now will delve into the reasons behind this anticipated change.

Conclusion

At this time last year, we identified 2023 as a potential inflection point for open access (OA) and asked whether its explosive growth had peaked. The data from 2024 suggest otherwise: OA output has not peaked, but it has plateaued, holding steady around the 50% mark. The surge driven by special issues has subsided, but the worst effects of journal delisting now appear to be behind us. Fully OA publishing is stabilizing and poised for renewed - albeit more modest - growth in 2025.

Meanwhile, as fully OA steadies, hybrid OA and large corporate publishers are consolidating their positions. Hybrid output and revenue continue to rise, outpacing the broader market and poised to represent a sizeable portion of OA revenues within the next two years. We estimate that by 2027, hybrid could make up one-third of OA output and account for nearly half of OA market value-- a reflection of higher prices and a shift in author preference toward more established publishing venues.

Looking ahead, we expect the OA market to continue its recovery, with value growth outstripping output growth. OA’s share of total market value is projected to rise to 25% by 2027, even if the overall output stays roughly the same. This suggests a steady increase in publication fees and the normalization of higher-value OA publishing models.

The underlying demand for OA remains strong. The market has effectively self-corrected, with established players capitalizing on shifts in author behavior. The hypergrowth era may be over, but OA appears ready to reclaim its position as the fastest-growing segment of scholarly publishing--this time driven by consolidation, strategic pricing, and evolving business models.

---

Our industry does not systematically report comprehensive data about market volumes or value. So, any market sizing is an approximation, and figures should be taken as approximate. Subscribers to our Data & Analytics Tool can drill into the numbers in much greater depth, including analyzing fully OA vs. hybrid OA details, society-specific output and subscription output. Please get in touch if you want to know more.

---

This article is © 2025 Delta Think, Inc. It is published under a Creative Commons Attribution-NonCommercial 4.0 International License. Please do get in touch if you want to use it in other contexts – we’re usually pretty accommodating.

TOP HEADLINES

NERL Partners with OA Switchboard to Advance Transparency in Open Access – October 15, 2025

"NERL is pleased to announce that it has signed a 3-year agreement with OA Switchboard, an intermediary that facilitates the transmission of standardized OA publication data between institutions, publishers, and funders. By joining in this collaborative effort...NERL members will be supporting global OA infrastructure with metadata that is authoritative, transparent, and timely."

De Gruyter Brill to Add 66 More Journals to its Subscribe to Open (S2O) Program in 2026 – October 1, 2025

"In 2026, De Gruyter Brill will significantly expand its Subscribe to Open (S2O) program, DG2O, by transitioning 66 additional De Gruyter journals to open access. This brings the total number of titles in the program to 124, marking a major milestone in the publisher’s ongoing commitment to making high-quality research accessible worldwide."

AAAS: Response on NIH public access policy – September 24, 2025

"AAAS has responded to the National Institutes of Health’s request for input on its plan for “Maximizing Research Funds by Limiting Allowable Publishing Costs,” as released in July 2025. AAAS’ response applauds NIH for addressing the rising Article Processing Charges that scientific journal publishers are increasingly charging NIH-supported scientists to publish their findings."

OA JOURNAL LAUNCHES

American Society of Anesthesiologists Launches New Journal Anesthesiology Open – October 1, 2025

"The American Society of Anesthesiologists (ASA) today announced the launch of Anesthesiology Open, a new online, peer-reviewed, open access journal published by Wolters Kluwer. Anesthesiology Open’s website and manuscript submission site are now live."