News & Views: Open Access Charges – Consolidation Continues

Each year we survey the list Article Processing Charges (APCs) of a sample of major and significant publishers. Covering over 16,000 titles, this represents one of the most comprehensive reviews of open access pricing.

Headline Changes

To compare like for like, we analyze non-discounted, CC BY charges. Overall, list prices are increasing slowly:

- Maximum APCs for hybrid journals have risen noticeably, from $5,200 two years ago, to $5,650 last year, to $5,900 this year.

- The highest prices for fully OA journals have risen from $5,200 to $5,435.

- Fully OA journal APCs are less expensive than hybrid, averaging around 53% of hybrid average APCs. This difference has not changed significantly over the last few years.

- Average hybrid APCs continue to increase steadily, at very low single-digit percentages. Increases are accelerating slightly – from around 1% per year two years ago, to around 2% this year.

- This is contrasted with fully OA average price increases of 4% over the last year.

Shifts Within Portfolios

As is always the case, market-wide headlines mask nuances per publisher. Most – but not all – of the larger organizations have increased both fully OA and hybrid average APCs.

However, the most important nuance lies in the spread of prices within a given publisher’s portfolio. For example, if the bulk of a publisher’s journals lie towards the lower end of its pricing, with just a few journals priced much higher, the average (mean) price will be higher than most people actually pay.

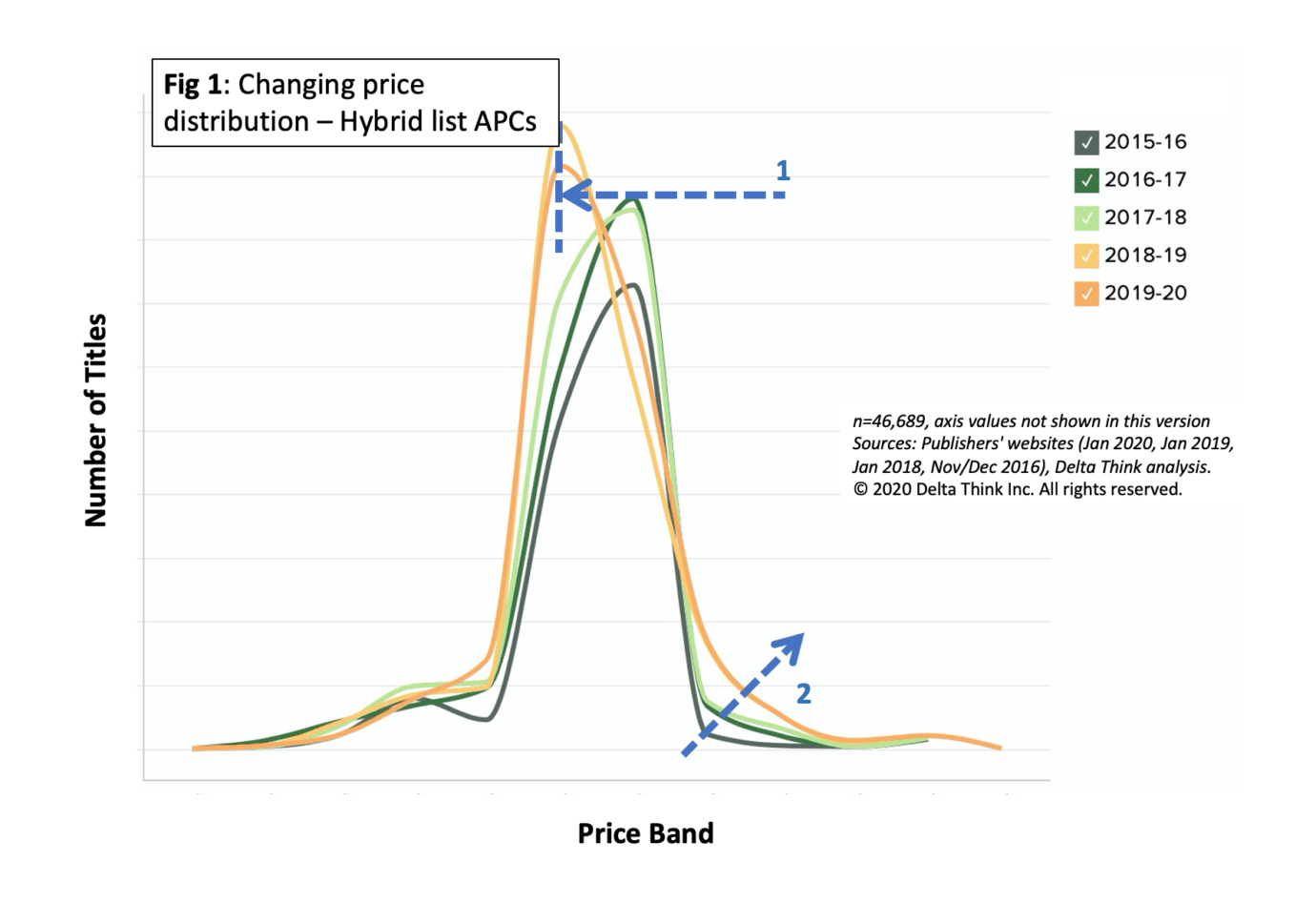

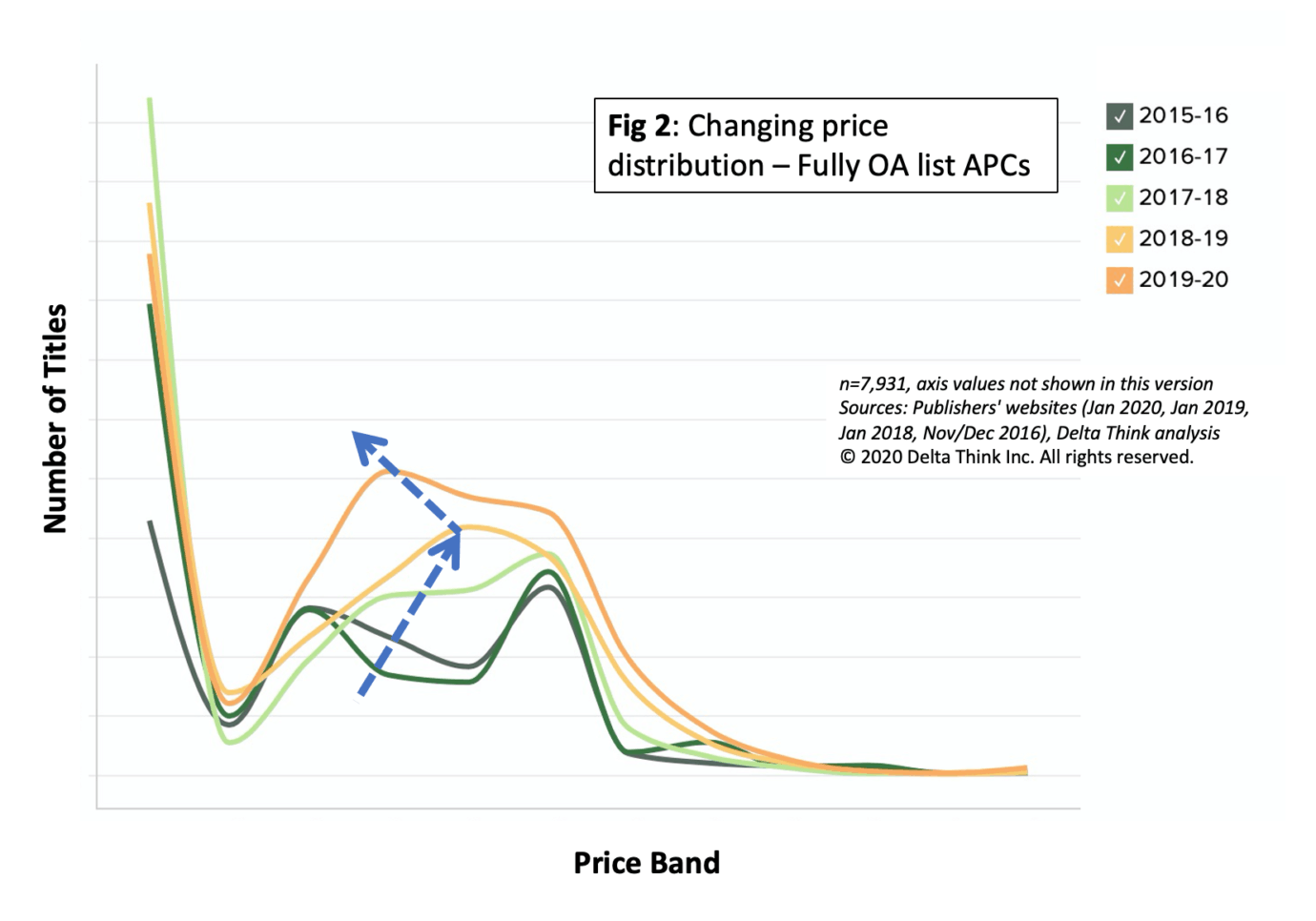

The following figures show how this plays out in the market across our sample of publishers. The figures are histograms, showing how many titles sit in various price bands over the four successive years of data that we have. For illustrative purposes, we have outlined the trends. The “more orange” the lines, the more recent the prices. As usual, subscribers to Delta Think’s Open Access Data and Analytics Tool can see full details of axes.

For hybrid journals – as shown in Figure 1 below – the overall spread of prices has remained relatively constant over time. But, the most popular price band has shifted towards the lower end of the market to a steady state over the last couple of years (1). This means the average author is likely to pay a lower price compared with a few years ago. However, there is also a small but increasing likelihood authors attracted to the mid to higher range journals will pay increasing prices (2). Notice how the righthand side of the yellow curve becomes more shallow, suggesting an increase in popularity of mid to high range pricing.

The fully OA landscape is more complicated, as shown in Figure 2. The extreme left shows journals without APCs ($0). Their number appears to have fallen over the last couple of years. Moving to the right, a few years ago (green lines), there was a double-hump in the curve, suggesting two popular price bands. Over the last couple of years, the bands have merged into what amounts to a broad range of prices, with averages getting cheaper over time.

Conclusion

With almost 55,000 APC data points in our database, we are able to identify emerging trends in pricing. Hybrid prices appear to be holding steady, although – as we predicted this time last year – we see higher charges at the higher end of the market. Meanwhile, the lowest fully OA APCs are getting lower, and there seems to be a downwards move in prices of fully OA journals – a reversal of what we saw last year.

It appears that a two-tier market is emerging, with hybrid prices holding their own, and fully OA prices decreasing. We know from the detailed analysis we have previously run via our Data and Analytics Tool that authors are not particularly price sensitive when choosing journals. So, it’s likely that changes in pricing are more due to publishers’ proactive choices, than to market forces. Of course, this may change as the effects of Plan S and the possibility of a US executive order become apparent.