News & Views: Falling Dollar, Rising Prices

After our previous analysis of the effects of inflation on APCs, we received a question about the effects of currency exchange rates. At a time when the dollar’s exchange rate is changing rapidly, what effect might that have for organizations buying services from abroad?

Background

Each year we survey the list Article Processing Charges (APCs) of more than 30 major and significant publishers. Going back to 2015, the dataset includes more than 20,000 unique titles and 150,000 title per year combinations. We have previously seen how headline prices typically increase each year, but mostly fall in real terms, once inflation is accounted for.

After our most recent analysis, we were asked by a US-based institution whether our inflation numbers included currency effects. With the US dollar (USD) having weakened over the last few months, the institution found buying services priced in non-USD currencies to be significantly more expensive by the end of April 2025 compared with the start of the year.

We take a snapshot of APCs at the same time each year. To compare like-for-like across our global market, we normalize prices to USD. This practice is commonly used by economists when analyzing global data and happens to be the most commonly used currency in our sample. Many non-US publishers – especially larger ones – offer an option of USD prices alongside their native currencies (and perhaps others). So, we sample USD prices where quoted, which cover on average around 94% of our annual samples of around 15,000 journals. Otherwise, we convert the prices cited in the publisher’s native currency into USD using the average exchange rate the most recent full year available.

Effects of changing exchange rates

Our analysis of price changes includes the effects of annual changes in exchange rates for the subset of around 6% of non-USD journals in our sample. It also includes any changes made by non-US publishers to their USD prices. However, it does not include the effects of significant and quick changes to exchange rates. Given the volatility in the US dollar over the last few months, we can dig deeper to explore the impact of these changes. And are there winners and losers depending on who’s buying or selling?

Sources: LSEG Data & Analytics, US Treasury, Publishers’ websites (Dec 2016, Jan 2018-Jan 2025), Delta Think analysis. © 2025, Delta Think Inc. All rights reserved.

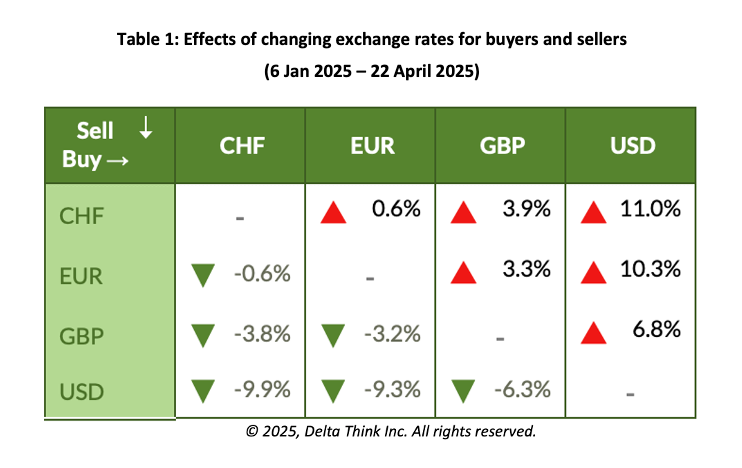

The figure above shows the effects of changing foreign exchange (FX) rates on purchases for different combinations of currencies.

- The rows show the currency in which prices are set, representing the seller. The columns show the currency of the buyer. The data show how exchange rates have changed between January 6, 2025, and April 22, 2025.

- For example, a US-based organization using USD (right-most column) to buy services priced in CHF (Swiss Francs, first row), will have seen the cost of fees increase by 11% between the two dates. The weaker dollar means more dollars are needed for the same price in CHF.

- Of course, the reverse is true. So, a Switzerland-based organization using CHF (left-most column of data) to buy services priced in USD (bottom row) will find things to be cheaper by 9.9%.

- Our color-coding takes the perspective of buyers (red/up-arrows more expensive, green/down cheaper), reflecting the original question we were asked.

- Note how things have become significantly more expense for those buying using USD over the 15 weeks spanned by the table.

- To put the numbers in context, going into 2025, average APCs rose by 3% across our annual sample, which translated to a fall of 2.7% in real terms.

- The table represents a snapshot in time, to illustrate how profoundly costs might be affected by changes in exchange rates. As exchange rates fluctuate throughout the year, so will the costs.

Long term effects

We have looked at the last few months, but how does the picture look over the longer term?

n=125,164. Sources: LSEG Data & Analytics, US Treasury, Publishers’ websites (Dec 2016, Jan 2018-Jan 2024), Delta Think analysis. © 2025, Delta Think Inc. All rights reserved.

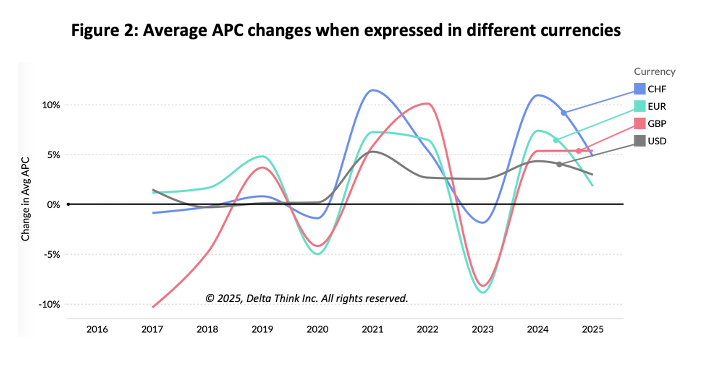

The figure above compares the annual changes in average APCs when expressed in different currencies.

- The baseline is the USD (grey) line, which shows our headline changes as we normally depict them.

- The other lines show what happens if we convert our average USD APCs to other currencies using the average exchange rates for each year. We use the averages for the most recent full year just ended. So, e.g. the 2025 changes are based on average FX rates for 2024.

- Note how the prices may shrink or grow at significantly different rates depending on the currency. For example, going into 2023 average prices increased if priced in USD, but fell if priced in other currencies.

- The chart analyzes changes in prices and so is affected by changes in exchange rates. For example, just before and after Brexit in 2016, the Pound’s (GBP) value fell. As it then stabilized to a less volatile range, its annual changes moved more in line with other currencies.

- Although not shown on the chart, our analysis suggests that, as a rough guide, if the strength of the dollar falls, average APCs in non-USD currencies increase, and vice versa.

Conclusion

To the question of whether our inflation analysis incorporates currency effects, the answer is “partly”. Our annual sampling method does not resolve short-term changes, which are not included. Annual averages in exchange rates only affect a few percent of prices in our long-term tracking and thus are included in our headline changes. If exchange rates impact the Consumer Price Index (CPI), then they would form part of inflation and impact our real-terms benchmarks.

Whatever the methodology, the real world is moving quickly. Recent rapid and significant changes in the value of the dollar have made it more expensive for US institutions to buy from outside the US. Our analysis shows the profound effects of a weaker dollar on APCs over a period of just 15 weeks.

Where publishers offer prices only in their local currencies, costs for US-based institutions have increased by more than 10% in some cases. These costs don’t directly translate into higher margins for publishers and vendors – they are just an increased cost of doing business. Of course, non-US buyers benefit from cheaper prices (which may feed through to margins). Meanwhile, non-US vendors offering US prices may see less value coming into their organizations when USD purchases are converted to balance sheets in local currencies (which may also affect margins). Larger organizations may have hedging strategies in place, but these can only go so far in highly volatile markets.

Scholarly publishing is a highly global and widely distributed industry, so volatile currency effects are nothing new. We have previously explored how exchange rates can profoundly affect market values. Many large corporate organizations report their finances both with and without currency effects so investors can see what changes in the currency markets mean. Our long-term analysis here shows how changes in currency rates regularly affect price swings – both for better and worse. Global disruption has been the new normal, with Brexit, COVID, and the war in Ukraine as just a few of many examples.

We don’t yet know how far the dollar will fall, or whether it will bounce back. Crises seem to be unfolding in real time – for example, the India/Pakistan escalated and de-escalated during the preparation of this piece of analysis. For those wrestling with budgets, we can only suggest baking in some contingency for exchange rates. Things may get worse before they get better.

---

This article is © 2025 Delta Think, Inc. It is published under a Creative Commons Attribution-NonCommercial 4.0 International License.

Please do get in touch if you want to use it in other contexts – we’re usually pretty accommodating.

---

TOP HEADLINES

Duke University Press to publish open access monographs through MIT Press’s Direct to Open (D2O) – May 6, 2025

"The MIT Press is proud to announce that beginning in 2026, Duke University Press will join our Direct to Open (D2O) program. This collaboration marks the first such partnership with another university press for the D2O program, and reaffirms our shared commitment to open access publishing that is ethical, equitable, and sustainable."

COS Launches Call for Developers to Enhance Open Science Framework with Support from NSF – May 1, 2025

"The Center for Open Science (COS) has issued a Request for Proposals (RFP) inviting open-source development teams and independent developers to collaboratively enhance the Open Science Framework (OSF) as part of the National Science Foundation's Pathways to Enable Open-Source Ecosystems (POSE) program."

Notice of Updated Effective Date for the 2024 NIH Public Access Policy – April 30, 2025

"NIH’s default position is maximum transparency regarding research and research findings. This Notice updates the Effective Date of the 2024 NIH Public Access Policy, NOT-OD-25-047, to July 1, 2025 at which time it will replace the 2008 Public Access Policy. All other aspects of the Policy remain the same."

OA JOURNAL LAUNCHES

Journals in Taylor & Francis collective funding pilot reach target for full open access publishing - April 28, 2025

"Taylor & Francis has confirmed both journals in its innovative pilot, Collective Pathway to Open Publishing (CPOP), will be converted to open access (OA) for 2025. Announced in November 2024, CPOP has been devised as an alternative OA model for Humanities and Social Sciences (HSS) journals, particularly those focused on regions with a high uptake of OA agreements."